Quicklinks

Quicklinks

According to preliminary unaudited figures, Hamburger Hafen und Logistik AG (HHLA) recorded a drop in its Group revenue of 8.3 percent to € 1,447 million in the 2023 financial year (previous year: € 1,578 million). The Group operating result (EBIT) came to € 109 million, thus falling below the expected range of € 115 million to € 135 million (previous year: € 220 million). Group profit after tax and minority interests amounted € 20 million (previous year: € 93 million). Group container throughput decreased by 7.5 percent to 5,917 thousand TEU (previous year: 6,396 thousand TEU). The Hamburg container terminals reported a year-on-year decrease of 6.3 percent. Transport volumes fell by 5.4 percent to 1,602 thousand TEU (previous year: 1,694 thousand TEU).

Angela Titzrath, HHLA’s Chief Executive Officer: “In 2023, the war in Ukraine, geopolitical tensions, high inflation rates and increased interest rates had an impact on the global economy and increasingly dampened economic development over the course of the year. This also had an impact on the entire logistics industry and HHLA’s business, causing a result just below our expectations. Despite these challenging conditions, we managed to hold our own. We are consistently implementing our investments in automation to increase efficiency and are continuing to drive forward our activities to expand sustainable and networked logistics solutions.”

In the publicly listed Port Logistics subgroup, revenue decreased by 8.6 percent to € 1,409 million (previous year: € 1,542 million). The operating result (EBIT) decreased by 53,9 percent year-on-year to € 93 million (previous year: € 202 million), placing it significantly below the most recent forecast, which had assumed earnings at the lower end of the range between € 100 million and € 120 million. Profit after tax and minority interests amounted € 9 million (previous year: € 82 million). Revenue and earnings performance in the financial year was negatively affected by a year-on-year reduction in storage fees in the Container segment and the partially marked decline in throughput and transport volumes due to the economic situation. Volume development in the Container segment was also affected by the loss of feeder traffic with Russia as a result of EU sanctions and the war-related decrease in cargo volumes at the Ukrainian Container Terminal Odessa (CTO).

The Real Estate subgroup recorded a 5.3 percent increase in revenue in the 2023 financial year, bringing it to € 46 million (previous year: € 44 million). The operating result (EBIT) fell year-on-year by 12.5 percent to € 16 million (previous year: € 18 million), mainly due to increased amortization and depreciation as well as higher maintenance expenses. Profit after tax and minority interests amounted € 11 million (previous year: € 11 million).

At the Annual General Meeting on 13 June 2024, the Executive Board and Supervisory Board will propose a dividend of € 0.08 per dividend-entitled class A share. HHLA therefore continues to pursue its dividend policy of distributing between 50 and 70 percent, where possible, of the Port Logistics subgroup’s relevant net profit for the year to its shareholders.

The Annual Report with audited figures for the 2023 financial year will be published at 7.30 a.m. on Thursday, 21 March 2024.

Download image

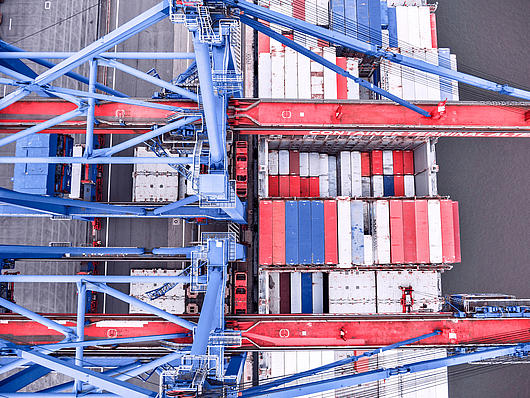

Container handling at Container Terminal Altenwerder in Hamburg