09.05.2019

HHLA once again increases revenue and profitability

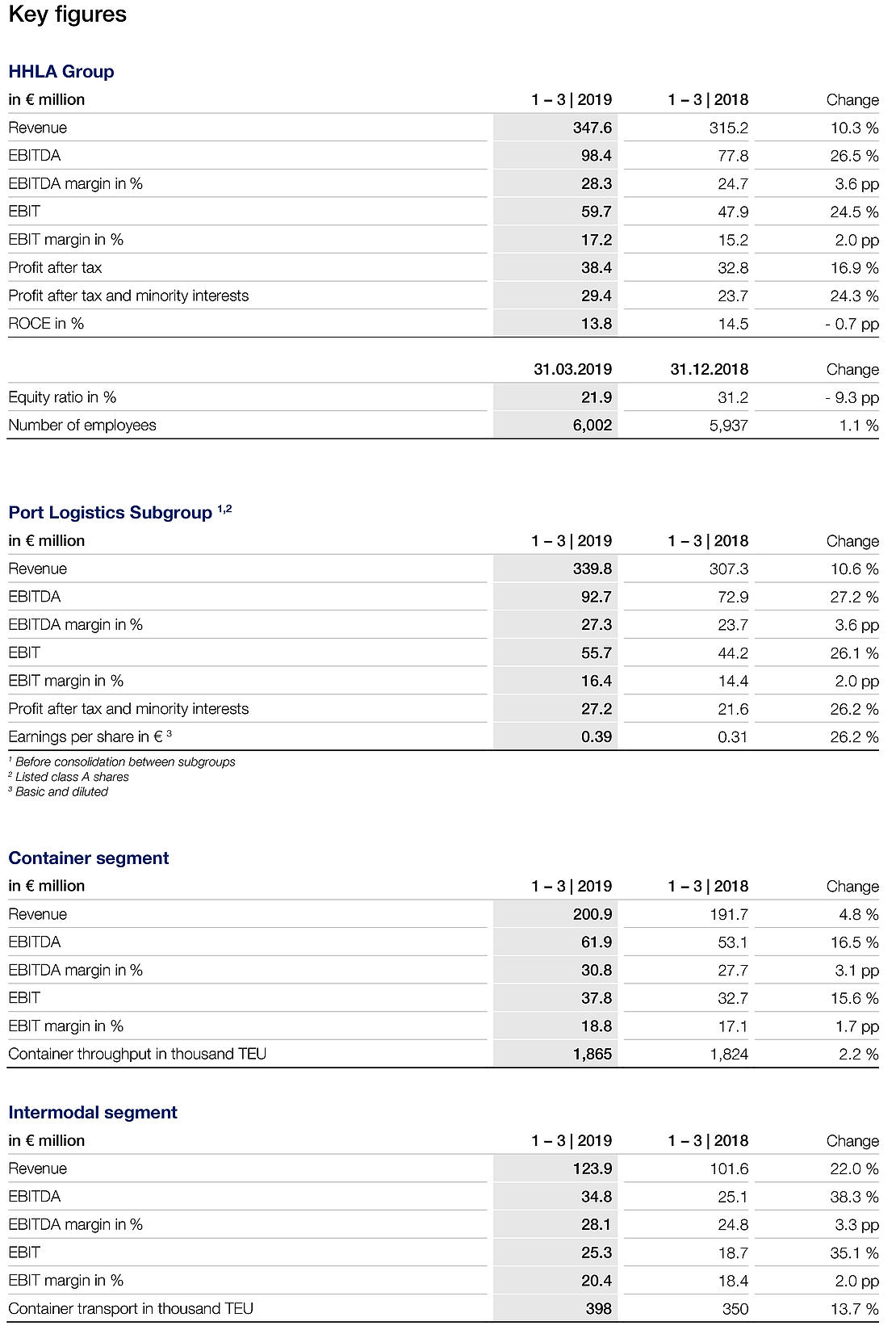

- Group revenue increases by 10.3 %; Group operating result (EBIT) rises by 24.5 %

- Significant rise expected in the operating result for the year as a whole

- Chairwoman of the Executive Board, Angela Titzrath: “The results attained provide a firm basis for us to reach our guidance for the year.”

The Hamburger Hafen und Logistik AG (HHLA) enjoyed a successful start to the 2019 financial year. In a challenging market environment, revenue and the operating result rose strongly in the first three months along with further improvements in profitability. Container throughput increased slightly, partly due to the successful integration of the Estonian terminal operator HHLA TK Estonia last year. Extremely positive performance in container transport and property management led to a revenue of € 347.6 million (+ 10.3 %). The operating result (EBIT) was far above the level of last year, increasing by € 11.8 million or 24.5 % to € 59.7 million. Effects from the initial application of the IFRS 16 standard only resulted in an increase of € 3.5 million.

Angela Titzrath, Chairwoman of HHLA’s Executive Board: “The results attained in the first quarter provide a firm basis for us to reach our guidance for the year. We are therefore intensifying our efforts to systematically implement our strategy, which is focussed on strengthening our creative power and future viability. Our customers measure us by our ability to live up to our performance promise. As a result, we constantly strive to achieve further improvements in our productivity, quality and reliability.”

Port Logistics subgroup: performance January to March 2019

The listed Port Logistics subgroup saw a 10.6 % increase in revenue in the first three months to € 339.8 million, while the operating result (EBIT) rose strongly by 26.1 % to € 55.7 million. The EBIT margin improved by 2.0 percentage points to 16.4 %.

In the Container segment, volume rose slightly by 2.2 % to 1,865 thousand standard containers (TEU). This was significantly influenced by the positive development of the international terminals in Tallinn and Odessa. Revenue for the segment increased by 4.8 % year-on-year in the first three months to € 200.9 million. This was caused by a temporary increase in storage fees and a further rise in the rail share. The operating result (EBIT) increased by € 5.1 million or 15.6 % year-on-year to € 37.8 million. Of this increase, € 2.6 million is attributable to the application of IFRS 16. The EBIT margin improved by 1.7 percentage points to 18.8 %.

In the first quarter of 2019, HHLA’s transport companies achieved strong growth in the Intermodal segment. With an increase of 13.7 %, container transport rose to 398 thousand standard containers (TEU). This trend was driven by growth in both rail and road transport. Compared with the previous year, rail transport increased by 14.7 % to 310 thousand TEU. After a weak quarter in the previous year, road transport recovered due to the strong increase in delivery volumes, and recorded growth of 10.1 % to 88 thousand TEU in a challenging market environment. At € 123.9 million, revenue was 22.0 % up on the previous year. This strong growth in revenue was largely due to a further slight increase in the rail share, combined with a favourable freight flow structure and longer transport distances. As a result of the positive trends in volume and revenue, the operating result (EBIT) increased by 35.1 % to € 25.3 million. Additionally, lower route prices in Germany made it possible to further increase the capacity utilisation of train systems. The application of IFRS 16 did not have a major influence on the positive EBIT trend.

Port Logistics subgroup: outlook

Due to the takeover of North America services and the first full-year consolidation of throughput volumes of the HHLA TK Estonia container terminal, HHLA expects a slight overall increase in container throughput in 2019. Slight year-on-year growth is also expected for container transport. At a Group level, this should lead to a slight increase in revenue.

The operating result (EBIT) of the Port Logistics subgroup is expected to rise significantly year-on-year in 2019, largely due to the changes in lease accounting policy (IFRS 16) as of 2019. Earnings for the subgroup will be shaped largely by the Container and Intermodal segments. Stable EBIT growth on a par with the previous year is expected for the Container segment, while significant growth is expected for the Intermodal segment.

Real Estate subgroup: performance January to March 2019 and outlook

HHLA’s properties in the Speicherstadt historical warehouse district and in the fish market area continued their positive revenue trend in the first quarter of 2019. Revenue again increased moderately by 3.5 % year-on-year to € 9.8 million as a result of virtually full occupancy in both districts this year as well as last year. With a slight increase in maintenance costs, the 6.4 % increase in the operating result (EBIT) to € 3.9 million was largely due to the application of IFRS 16.

The operating result (EBIT) for the Real Estate subgroup is expected to be around € 15 million due to scheduled, large-scale maintenance work that does not qualify for capitalisation.

The Interim Statement is available at:

report.hhla.de/interim-statement-q1-2019

Download image

The automated storage blocks at HHLA Container Terminal Burchardkai (CTB) in Hamburg