12.05.2022

Financial year 2022 starts successfully for HHLA in challenging times

- Container throughput rises by 3.7 percent to 1,740 thousand TEU

- Moderate increase in container transport of 3.1 percent to 431 thousand TEU

- Forecast for financial year 2022 unchanged

- Chairwoman of the Executive Board, Angela Titzrath: “The successful business performance in a difficult, uncertain environment underscores the reliability and strength of HHLA.”

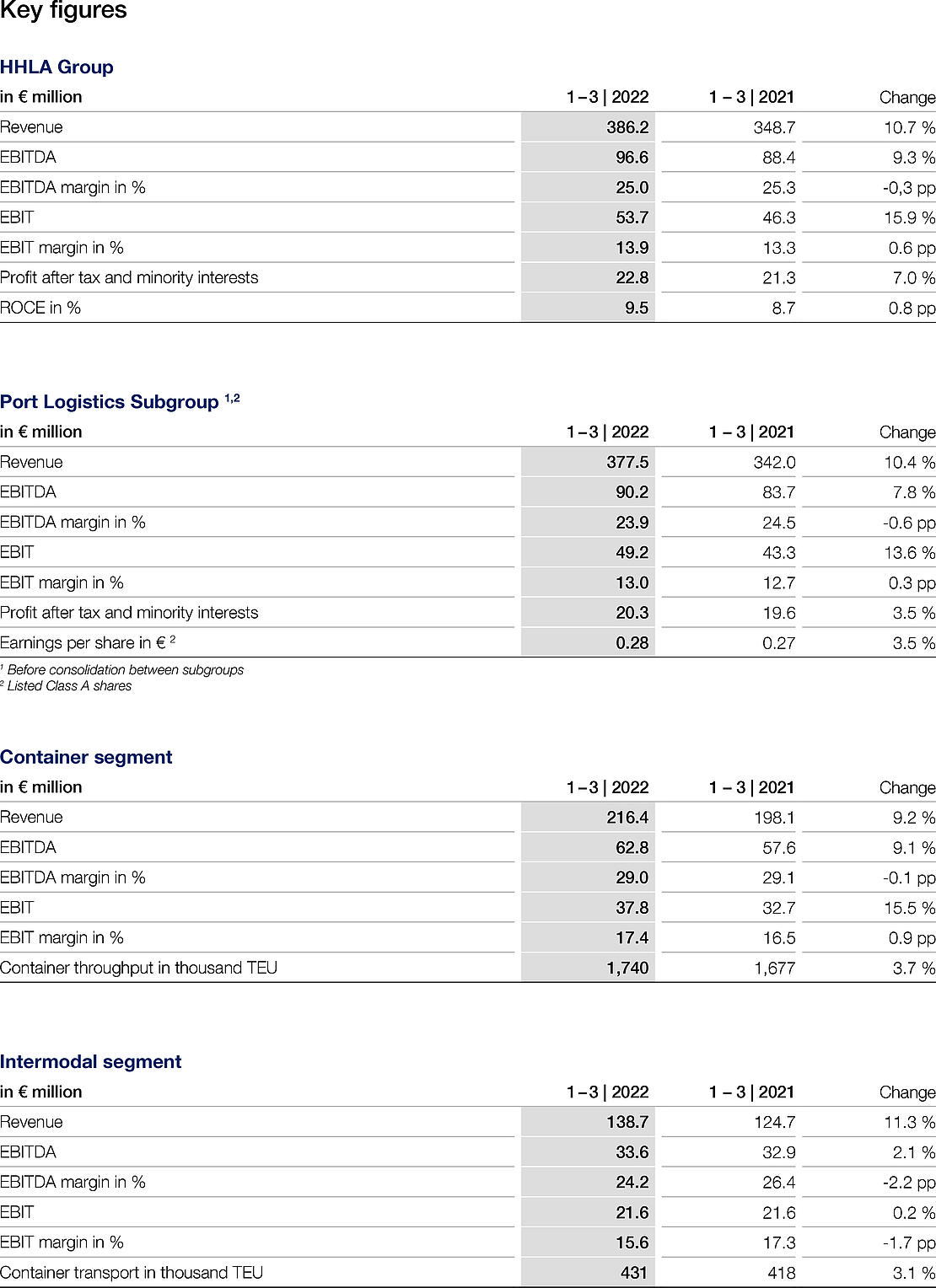

The revenue and earnings of Hamburger Hafen und Logistik AG (HHLA) recorded a strong performance in the first three months of the year. Revenue in the HHLA Group rose by 10.7 percent to € 386.2 million (previous year: € 348.7 million). While all of the Group’s segments contributed to the positive revenue performance, the increase in the Group operating result (EBIT) was essentially due to a further rise in storage fees in the Container segment and a further increase in the rail share of HHLA’s total intermodal transportation. The Group operating result (EBIT) climbed by 15.9 percent to € 53.7 million (previous year: € 46.3 million). The EBIT margin thus came to 13.9 percent (previous year: 13.3 percent). Profit after tax and minority interests rose by 7.0 percent to € 22.8 million (previous year: € 21.3 million).

Angela Titzrath, Chairwoman of HHLA’s Executive Board: “The existing uncertainty on the global markets created by the coronavirus pandemic has been further amplified by the escalation of the Russia-Ukraine conflict. For several months, we have been dealing with massive ship delays as a result of supply chain disruptions, and this has led to a backlog of containers at the Port of Hamburg. However, irrespective of the difficult, unsettling times, HHLA got off to a good start in the 2022 financial year. Through prudent and disciplined action, HHLA is maintaining the stability of its operations and thus fulfilling its supply mandate for businesses and consumers. In order to reliably meet the needs of its customers, HHLA’s employees and equipment are currently operating at full capacity and HHLA has implemented additional operational measures. Despite the challenges facing us, we will decisively and consistently seize the opportunities of the digital transformation and the drive towards climate-neutrality so that we can continue to strengthen HHLA’s future viability.”

Port Logistics subgroup: performance January – March 2022

The listed Port Logistics subgroup recorded a strong increase of 10.4 percent in revenue to € 377.5 million in the first three months (previous year: € 342.0 million). The operating result (EBIT) rose year-on-year by 13.6 percent to € 49.2 million (previous year: € 43.3 million). The EBIT margin increased slightly by 0.3 percentage points to 13.0 percent (previous year: 12.7 percent). Profit after tax and minority interests was up 3.5 percent year-on-year, from € 19.6 million to € 20.3 million. Earnings per share thus amounted to € 0.28 (previous year: € 0.27).

In the Container segment, container throughput increased by 3.7 percent to 1,740 thousand standard containers (TEU) (previous year: 1,677 thousand TEU). This positive development was essentially driven by an increase in the Far East shipping region – China in particular. In addition, the acquisition of a feeder service for the Baltic Sea region in the third quarter of 2021 and another two services in the first quarter of 2022 led to strong growth in feeder traffic volumes. This more than offset the collapse in volumes to and from Russia in March 2022 as a result of the sanctions imposed by the EU. Feeder services accounted for 21.2 percent of seaborne handling in the first quarter of 2022, which was significantly higher than in the previous year (previous year: 19.7 percent).

Despite significant volume growth at TK Estonia and additional volume at PLT Italy after handling its first container ship in December 2021, total throughput volume at the international container terminals decreased by 15.3 percent to 122 thousand TEU (previous year: 144 thousand TEU). This was due to the significant decline in cargo volumes at the terminal in Odessa after operations there were suspended by the authorities at the end of February following the Russian invasion.

Segment revenue rose significantly year-on-year by 9.2 percent to € 216.4 million in the first three months of 2022 (previous year: € 198.1 million). Moderate volume growth was outpaced by a significant increase in average revenue. The latter resulted from additional revenue from RoRo and bulk cargo handling at PLT Italy and in particular from the significant rise in storage fees at the container terminals in Hamburg and Tallinn. The increase in storage fees was due to longer dwell times caused by backlogs in the supply chain. Against this background, the operating result (EBIT) climbed by 15.5 percent to € 37.8 million (previous year: € 32.7 million). The negative development of the Container Terminal Odessa (CTO) and its impact on earnings was more than offset by the other terminals. The EBIT margin increased by 0.9 percentage points to 17.4 percent (previous year: 16.5 percent).

In the Intermodal segment, container transport increased overall by 3.1 percent to 431 thousand TEU (previous year: 418 thousand TEU). Rail transport rose significantly by 7.3 percent year-on-year to 361 thousand TEU (previous year: 336 thousand TEU). Traffic from the North German seaports achieved strong growth, while the volume transported from the Adriatic seaports increased moderately. Road transport saw a marked decrease in the first quarter of 2022. In a persistently challenging market environment, transport volumes decreased by 13.8 percent to 71 thousand TEU (previous year: 82 thousand TEU).

With year-on-year growth of 11.3 percent to € 138.7 million (previous year: € 124.7 million), revenue growth was considerably stronger than the increase in transport volumes. This was due to the further rise in the rail share of HHLA’s total intermodal transportation from 80.4 percent to 83.6 percent and a change in the structure of freight flows.

The operating result (EBIT) amounted to € 21.6 million in the reporting period (previous year: € 21.6 million). The EBIT margin fell by 1.7 percentage points to 15.6 percent (previous year: 17.3 percent). The main reason for this weak EBIT performance was the strong rise in energy prices. Operational interruptions due to storm damage in February and the disruptions to international transport chains also had a negative impact on earnings.

Real Estate subgroup: performance January – March 2022

The impact of the Russian invasion of Ukraine on the market for office space in Hamburg was initially not felt in the first quarter of 2022. HHLA’s properties in the Speicherstadt historical warehouse district and the fish market area thus maintained their stable trend with almost full occupancy in the first quarter of the current financial year.

Revenue rose significantly by 17.4 percent in the reporting period to € 10.7 million (previous year: € 9.1 million). In addition to the reactivation of revenue-based rent agreements, the increase was due in part to rising rental income from newly developed properties in the Speicherstadt historical warehouse district.

The cumulative operating result (EBIT) rose by 51.1 percent to € 4.4 million in the reporting period (previous year: € 2.9 million). In addition to the increase in revenue, this positive earnings trend was also due to lower maintenance costs.

Forecast for financial year 2022 unchanged

In the first three months of the 2022 financial year, there were no new events of material importance to necessitate any change to the expected course of business in 2022 as published in the 2021 Annual Report at the end of March. The uncertainties outlined and disclosures made in the 2021 Annual Report regarding the expected business performance in 2022 therefore continue to apply.

The Interim Statement is available at:

report.hhla.de/interim-statement-q1-2022

Download image

Automated container yard at the HHLA Container Terminal Burchardkai in Hamburg.