14.08.2018

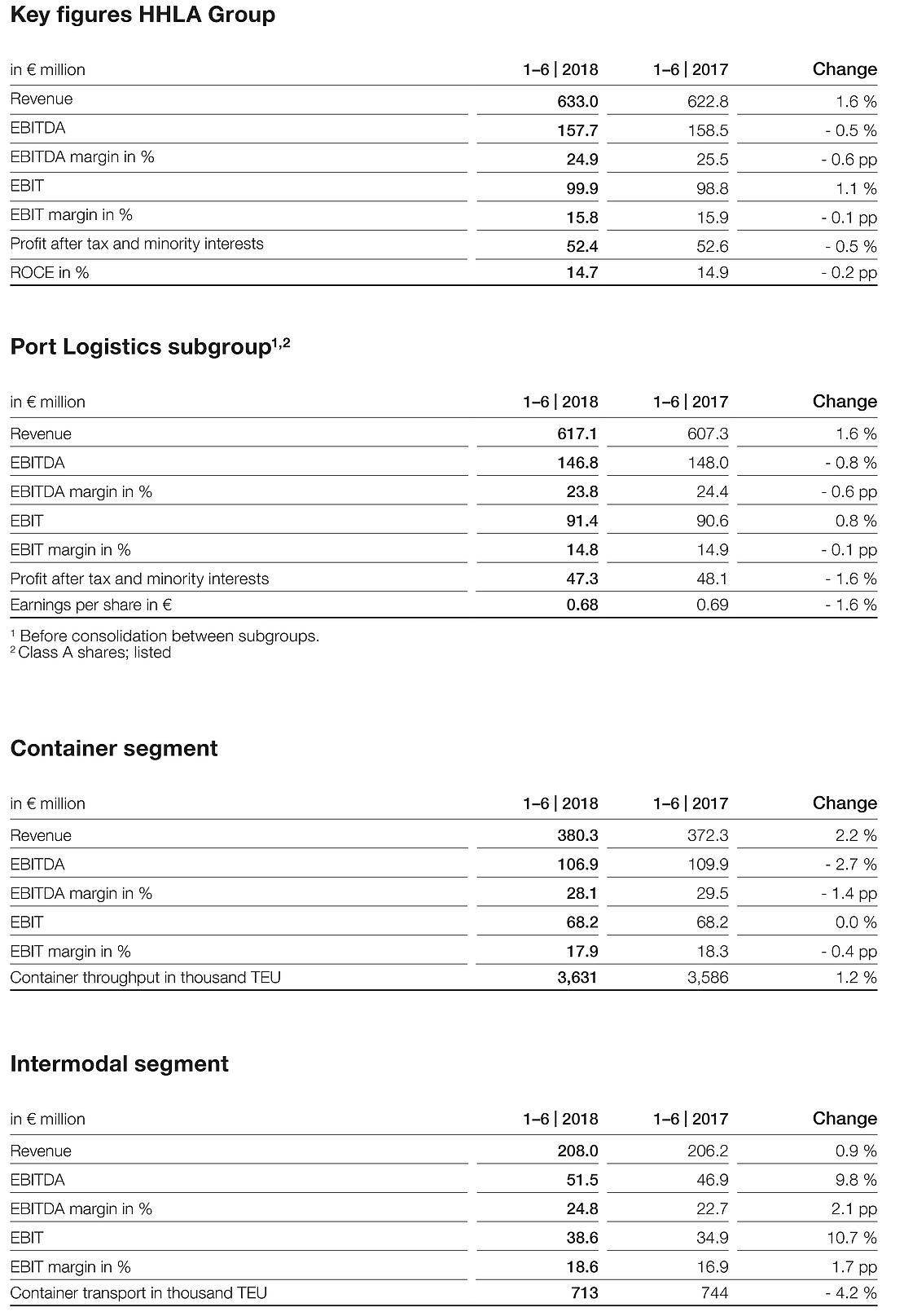

In the first half of 2018, Hamburger Hafen und Logistik AG (HHLA) improved on the already strong prior-year result. Both Group revenue and the Group operating result increased slightly in the first six months against the same period of the previous year, which was already very strong. This development was driven by both subgroups, the listed Port Logistics subgroup and the Real Estate subgroup. A 1.2 percent increase in container throughput was recorded. As projected, container transport declined by 4.2 percent on account of the realignment of Polzug activities following its successful integration into the Metrans group. Revenue in the Port Logistics subgroup was up by 1.6 percent.

HHLA confirms its targets for the current financial year of keeping revenue in the region of the high level of the previous year and achieving considerably higher EBIT in the Port Logistics subgroup and at Group level.

Angela Titzrath, Chairwoman of HHLA’s Executive Board: “HHLA’s positive performance in the first half of the year gives us confidence that we will achieve the targets announced for the financial year. HHLA has the knowledge and experience to cope with the challenges of a volatile market. Working closely with our customers and being a reliable partner to them, all while offering exceptionally good service and a high degree of professionalism, is a decisive factor in this regard. We work continuously to improve our processes and workflows so that we can safeguard efficiency and profitability. We are currently proactively harnessing the opportunities presented by digitisation, including amongst others the introduction of a new terminal operating system. At the same time, we are strengthening our position in our existing business. At the end of June, we acquired all shares in the largest Estonian terminal operator, Transiidikeskuse AS (TK), and are now integrating TK into the HHLA Group. As Hanseatic cities, Hamburg and the Estonian capital of Tallinn share a long tradition. Through our commitment, we aim to breathe new life into the spirit of the ‘Hanseatic mindset’, which is based on the fair granting of mutual benefits, the exchange of goods, ideas and culture, cross-border cooperation and learning from each other.”

Port Logistics subgroup: performance January to June 2018

Revenue in the listed Port Logistics subgroup was up slightly by 1.6 percent in the first six months to € 617.1 million. The operating result (EBIT) also rose slightly by 0.8 percent to € 91.4 million, with the EBIT margin remaining more or less stable at 14.8 percent.

In the Container segment, container throughput rose slightly by 1.2 percent to 3.6 million standard containers (TEU). This slight growth was mainly driven by a 4.1 percent increase in Asia traffic. Revenue rose by 2.2 percent to € 380.3 million, thereby somewhat outstripping container throughput – this is mainly attributable to the lower feeder ratio. The segment’s EBIT margin came in at 17.9 percent.

In the Intermodal segment, container transport declined moderately by 4.2 percent. This is due to the scheduled realignment of Polzug’s activities as part of its integration into the Metrans organisation. A slight increase in rail’s share, coupled with longer transport distances, resulted in revenue that performed significantly better, rising by 0.9 percent. Segment EBIT rose considerably by 10.7 percent to € 38.6 million, resulting in yet another increase in the EBIT margin, which came in at 18.6 percent.

Port Logistics subgroup: outlook

HHLA expects container throughput in 2018 to be in the region of the previous year. The container transport volume is also forecast to remain in the region of the previous year, as Polish intermodal traffic is being realigned in the course of its integration into Metrans. At subgroup level, this should mean that revenue is in the region of the previous year.

The operating result (EBIT) at the Port Logistics subgroup is expected to rise significantly year on year in 2018. Earnings will be driven largely by the Container and Intermodal segments.

Real Estate subgroup: performance January to June 2018 and outlook

Despite full occupancy of the HHLA quarters in the Speicherstadt historical warehouse district and Fischmarkt Hamburg-Altona having been largely reached in the previous year, the positive revenue trend continued in the first half of 2018, with revenue once again rising by 3.0 percent to € 19.3 million. In spite of the implementation of planned maintenance work, the segment EBIT rose by 4.9 percent to € 8.4 million, which was largely due to increased revenue from existing and newly developed properties. The EBIT margin climbed up further to 43.6 percent.

The operating result (EBIT) at the Real Estate subgroup for the whole of 2018 is expected to come in at approximately € 15 million due to planned, large-scale maintenance work that does not qualify for capitalisation.

The Half-year Financial Report is available at:

report.hhla.de/half-year-financial-report-2018