25.03.2021

HHLA achieves positive 2020 result in a challenging year

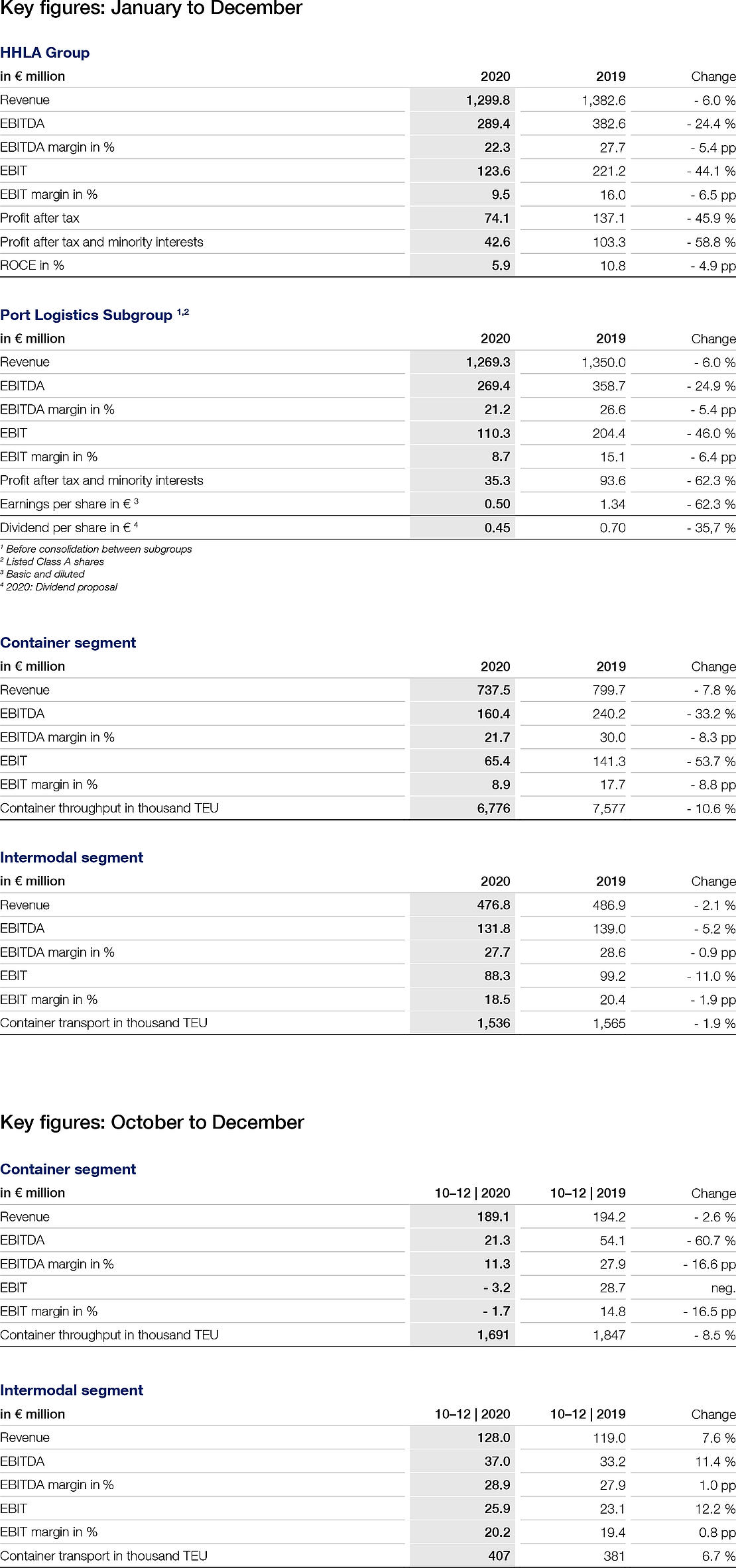

- However, revenue and operating result (EBIT) for 2020 significantly down on previous year

- Marked drop in container throughput, minor decrease in transport volume

- Dividend proposal of € 0.45 per Class A share in the form of a scrip dividend

- Moderate increase in revenue and operating result (EBIT) expected for 2021 financial year

- Chairwoman of the Executive Board, Angela Titzrath: Transformation process is being continued in order to facilitate new growth

In a financial year defined by the coronavirus pandemic and the associated social and economic upheavals, Hamburger Hafen und Logistik AG (HHLA) achieved a positive Group operating result (EBIT) of € 123.6 million in 2020 (previous year: € 221.2 million). In addition to decreases in volume as a result of the pandemic and changes in the market share, provisions amounting to approximately € 43 million also had an impact on the operating result. The provisions will be used to implement restructuring measures in the Container segment. Without the provisions, the Group EBIT would have been approximately € 167 million. Compared with the previous year, container throughput decreased by 10.6 percent to 6,776 thousand TEU. Transport volume amounted to 1,536 thousand TEU, a slight decrease (- 1.9 percent) on the high level of the previous year. Revenue for the HHLA Group decreased by 6.0 percent to € 1,299.8 million (previous year: € 1,382.6 million). Profit after tax and minority interests dropped by 58.8 percent to € 42.6 million (previous year: € 103.3 million).

Angela Titzrath, Chairwoman of HHLA’s Executive Board: “HHLA has weathered the effects of the coronavirus pandemic well until now. We will continue to reliably fulfil our responsibility as a service provider for Germany as an industrialised nation in 2021, too. This is something that consumers and companies alike can rely on. Regardless of the changing macroeconomic environment, we will decisively continue to pursue our transformation process in order to be able to fulfil our customers’ requirements even more efficiently and develop new growth areas.”

Port Logistics subgroup: business development in 2020

The listed Port Logistics subgroup recorded a significant decrease in revenue of 6.0 percent to € 1,269.3 million (previous year: € 1,350.0 million). Its operating result (EBIT) fell substantially by 46.0 percent to € 110.3 million (previous year: € 204.4 million), thereby decreasing its EBIT margin to 8.7 percent. In addition to decreases in volume as a result of the pandemic and changes in market share, the addition of restructuring provisions in the Container segment had a particularly marked impact. Without these provisions, the EBIT for the subgroup would have amounted to approximately € 153 million. Profit after tax and minority interests decreased by 62.3 percent to € 35.3 million (previous year: € 93.6 million). Earnings per Class A share came to € 0.50 (previous year: € 1.34).

In total, 6,776 thousand standard containers (TEU) were handled at HHLA’s container terminals in the 2020 financial year. This is 10.6 percent less than in the same period of the previous year (7,577 thousand TEU). At the three Hamburg terminals, the decline amounted to 11.1 percent. Virtually all shipping regions were impacted by pandemic-related volume shortfalls. This is especially true for the Far East region, which is of particular importance for HHLA. The loss of a Far East service from mid-May 2020 onwards had a further adverse effect on the volume trend. Decreasing overseas volumes and reductions in feeder traffic in the Baltic region could not be offset by growth in other shipping regions. The international terminals only showed a moderate de-crease of 4.7 percent.

Container transport volume decreased slightly by 1.9 percent to 1.54 million TEU (previous year: 1.57 million TEU). The decrease in road transport was much stronger than that of rail transporta-tion.

Real Estate subgroup: business development in 2020

HHLA’s properties in Hamburg’s Speicherstadt historical warehouse district and the Fish Market area recorded a slight decrease in revenue of 5.3 percent to € 38.1 million in 2020 (previous year: € 40.2 million) despite almost full occupancy. This mainly resulted from the partial waiving of rent deferrals granted during the pandemic.

While maintenance volume remained practically constant, decreases in revenue resulted in a fall in the operating result (EBIT) of 21.5 percent to € 12.9 million (previous year: € 16.5 million). The annual net profit dropped by 24.4 percent to € 7.3 million (previous year: € 9.7 million). Earnings per Class S share amounted to € 2.70 (previous year: € 3.57).

Forecast for 2021

Unprecedented measures were introduced around the globe in an effort to contain the spread of the pandemic. Given the uncertain conditions, it is therefore not possible to make a reliable forecast. This applies in particular to the intensity and timing of the economic recovery.

According to these assumptions, HHLA expects to see a moderate year-on-year increase for the Port Logistics subgroup, both in terms of container throughput and container transport, for the current financial year. A moderate year-on-year increase is also expected in terms of revenue. After the operating result (EBIT) in the financial year 2020 was burdened by net provisions amounting to approximately € 43 million for an efficiency programme in the Container segment, EBIT for the Port Logistic subgroup in the range of € 140 to 165 million is targeted for the current financial year.

A slight year-on-year increase in revenue is considered possible for the Real Estate subgroup with an operating result (EBIT) on par with the previous year.

At Group level, a moderate increase in revenue and an operating result (EBIT) in the range of € 153 million to € 178 million is anticipated.

In order to further increase productivity in the Container and Intermodal segments, capital expenditure at Group level is expected to be in the range of € 250 to 280 million in 2021. The Port Logistics subgroup will account for the major share of these investments (€ 220 to 250 million). The main focus of capital expenditure in the Container segment will be on the implementation of a restructuring and efficiency programme and in the Intermodal segment on the renewal and expansion of the Group’s own transport and handling capacities.

HHLA remains committed to its profit-oriented dividend policy, which aims to pay out between 50 and 70 percent of annual net profit after minority interests in the form of dividends.

Dividend proposal for 2020

The Executive Board and the Supervisory Board will propose to the Annual General Meeting on June 10, 2021, an optional dividend of € 0.45 per class A share entitled to dividends. During the determination, the result was adjusted by the change in the restructuring provision affecting net income in the amount of € 43 million. The resulting payout ratio is at the lower end of the payout corridor of 50 to 70 percent of the net profit for the year after non-controlling interests. Shareholders will thus again have the option of choosing between cash dividends and subscription to new shares.

The Annual Report is available at:

report.hhla.de/annual-report-2020

Download image

In 2020 container transport in the Intermodal segment was slightly down on the previous year.

Download image

In 2020 the number of containers handled at the terminals of HHLA was affected by the coronavirus pandemic.