12.05.2021

HHLA reports strong start into 2021

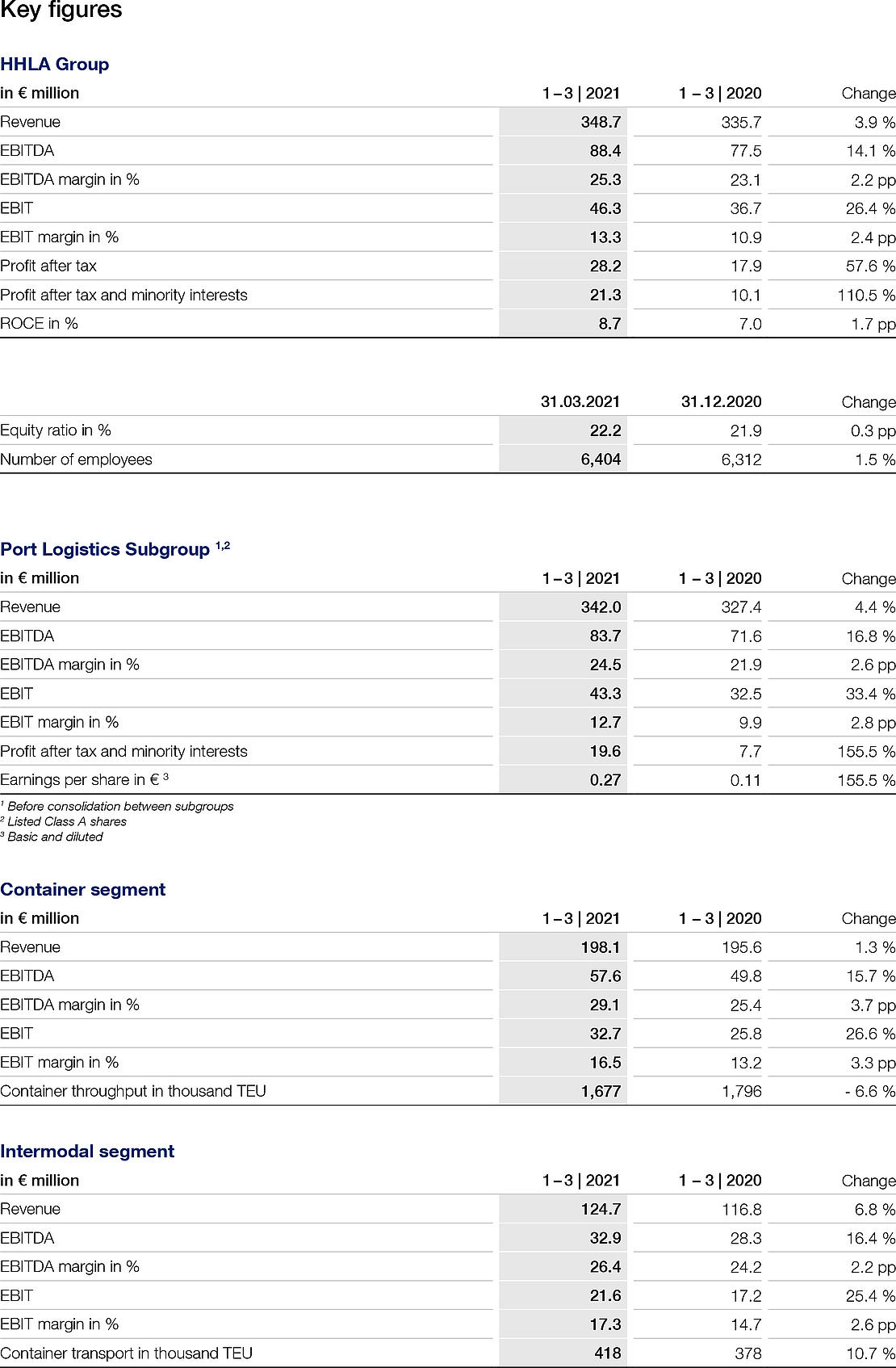

- Group revenue at € 348.7 million (+3.9 percent); operating result (EBIT) at € 46.3 million (+26.4 percent)

- Significant decrease of 6.6 percent in container throughput to 1,677 thousand TEU

- Strong increase in container transport to 418 thousand TEU (+10.7 percent)

- Chairwoman of the Executive Board, Angela Titzrath: “Strong start into the year makes us optimistic about our targets for the 2021 financial year”

Hamburger Hafen und Logistik AG (HHLA) started the 2021 financial year off strongly. Despite the continued influence of the coronavirus pandemic and the resulting global imbalances in transport flows, HHLA achieved a year-on-year increase of 26.4 percent in its Group operating result (EBIT) to € 46.3 million in the first quarter of 2021. The positive business development was attributable to high storage fees as a result of continued shipping delays at the Port of Hamburg as well as a strong increase in container transport volumes. Whereas container transport rose by 10.7 percent in the first quarter, container throughput fell significantly by 6.6 percent in the first three months of the year compared with the prior-year period. The decrease is due to the loss of a Far East service at Container Terminal Burchardkai in May 2020. Conversely, the Real Estate subgroup posted significant decreases in both revenue and earnings. In total, Group revenue increased by 3.9 percent to € 348.7 million.

Angela Titzrath, Chairwoman of HHLA’s Executive Board: “HHLA remains commercially successful even in the face of the ongoing challenges associated with the coronavirus pandemic. Based on the course of business in the first three months of the year, we are optimistic that we will achieve our targets for the 2021 financial year. We continue to implement our strategy of strengthening the competitiveness and future viability of HHLA with determination and consistency. We are focusing on measures to carry out the restructuring programme in the Container segment. Our customers can count on us to ensure the safe and reliable flow of goods despite various influences on the supply chains. Our rail subsidiary Metrans once again made an outstanding contribution to the positive course of business in the first quarter. 30 years after its foundation, Metrans has every reason to be proud of what it has achieved.”

Port Logistics subgroup: performance January to March 2021

The listed Port Logistics subgroup recorded a 4.4 percent rise in revenue to € 342.0 million in the first three months of 2021. The operating result (EBIT) increased significantly by 33.4 percent to € 43.3 million. The EBIT margin improved by 2.8 percentage points to 12.7 percent.

In the Container segment, the throughput volume decreased by 6.6 percent in the first quarter of 2021 to 1,677 thousand standard containers (TEU). This was mainly due to the loss of a Far East service in mid-May 2020. Cargo volumes for Far East services subsequently decreased slightly, while volumes for Middle East services fell strongly. There were also significant decreases in the United Kingdom shipping region and in feeder traffic in the Baltic region. While throughput volume at the three Hamburg container terminals was down 7.2 percent on the same period last year, the international container terminals in Odessa and Tallinn only recorded a slight decline of 0.3 percent to 143.8 thousand TEU. The multi-function terminal in Trieste went into operation in the first quarter, handling its first RoRo vessels.

Revenue in the segment increased year-on-year by 1.3 percent to € 198.1 million in the first quarter of 2021. Volume shortfalls were more than offset by an increase in revenue quality. This was due to an advantageous modal split with a high proportion of hinterland volumes and a temporary increase in storage fees resulting from longer dwell times caused by ongoing shipping delays. The operating result (EBIT) rose by 26.6 percent to € 32.7 million. The EBIT margin improved by 3.3 percentage points to 16.5 percent.

In the first three months of 2021, HHLA’s transport companies recorded a significant increase in volumes in the Intermodal segment. Container transport increased by 10.7 percent to 418 thousand standard containers (TEU). Rail continued to benefit more than road from the recovery in freight volumes that had already begun in the second half of 2020. Compared with the previous year, rail transport increased by 12.1 percent to 336 thousand TEU (previous year: 300 thousand TEU). There was a significant increase in traffic from both the North German and Adriatic seaports. However, the strong year-on-year growth was mainly attributable to the rise in continental traffic. The upward trend of the previous quarters continued for road transport. In a persistently challenging market environment, transport volumes increased year-on-year by 5.4 percent to 82 thousand TEU (previous year: 78 thousand TEU).

At € 124.7 million, revenue in the segment was up significantly by 6.8 percent on the previous year. However, this increase failed to match the strong rise in transport volumes. This was due to the fact that, despite a slight increase in the rail share of HHLA’s total intermodal transportation, average revenue per TEU decreased as a result of changes to the structure of freight flows. As a result of the positive trends in volume and revenue, the operating result (EBIT) increased by 25.4 percent to € 21.6 million. The EBIT margin improved by 2.6 percentage points to 17.3 percent.

Real Estate subgroup: performance January to March 2021

HHLA’s properties in the Speicherstadt historical warehouse district and the fish market area were again largely unaffected by local market fluctuations in the first quarter of 2021 and were almost fully occupied at the end of March 2021.

At € 9.1 million, revenue in the segment was down by 10.2 percent on the previous year despite the high occupancy rate. In addition to the partial waiving of rent deferrals, the decrease was primarily due to uncollectible revenue-based rent as a result of public orders.

While maintenance volumes remained constant, the segment’s cumulative operating result (EBIT) fell short of the previous year’s figure by 28.4 percent at € 2.9 million.

Forecast for 2021 confirmed

For the current 2021 financial year, HHLA still expects to see a moderate year-on-year increase for the Port Logistics subgroup, both in terms of container throughput and container transport. A moderate year-on-year increase is also expected in terms of revenue. After the operating result (EBIT) in the 2020 financial year was burdened by net provisions amounting to approximately € 43 million for an efficiency programme in the Container segment, EBIT for the Port Logistics subgroup in the range of € 140 to € 165 million is targeted for the current financial year. A slight year-on-year increase in revenue is still considered possible for the Real Estate subgroup, with an operating result (EBIT) on par with the previous year.

At the Group level, a moderate increase in revenue and an operating result (EBIT) in the range of € 153 million and € 178 million is anticipated.

In order to further increase productivity in the Container and Intermodal segments, capital expenditure at Group level is expected to be in the range of € 250 million to € 280 million in 2021. Of this, € 220 million to € 250 million is likely to be allocated to the Port Logistics subgroup. The main focus of capital expenditure in the Container segment will be on the implementation of a restructuring and efficiency programme and in the Intermodal segment on the renewal and expansion of the Group’s own transport and handling capacities.

HHLA will maintain its results-orientated dividend distribution policy, which aims to pay out between 50 percent and 70 percent of the annual net profit after minority interests, in the 2021 financial year.

The Interim Statement is available at:

report.hhla.de/interim-statement-q1-2021

Download image

Metrans train at the inland terminal in Ceska Trebova.