30.03.2016

Port and Transport Logistics – a Strategy that’s Proven Itself

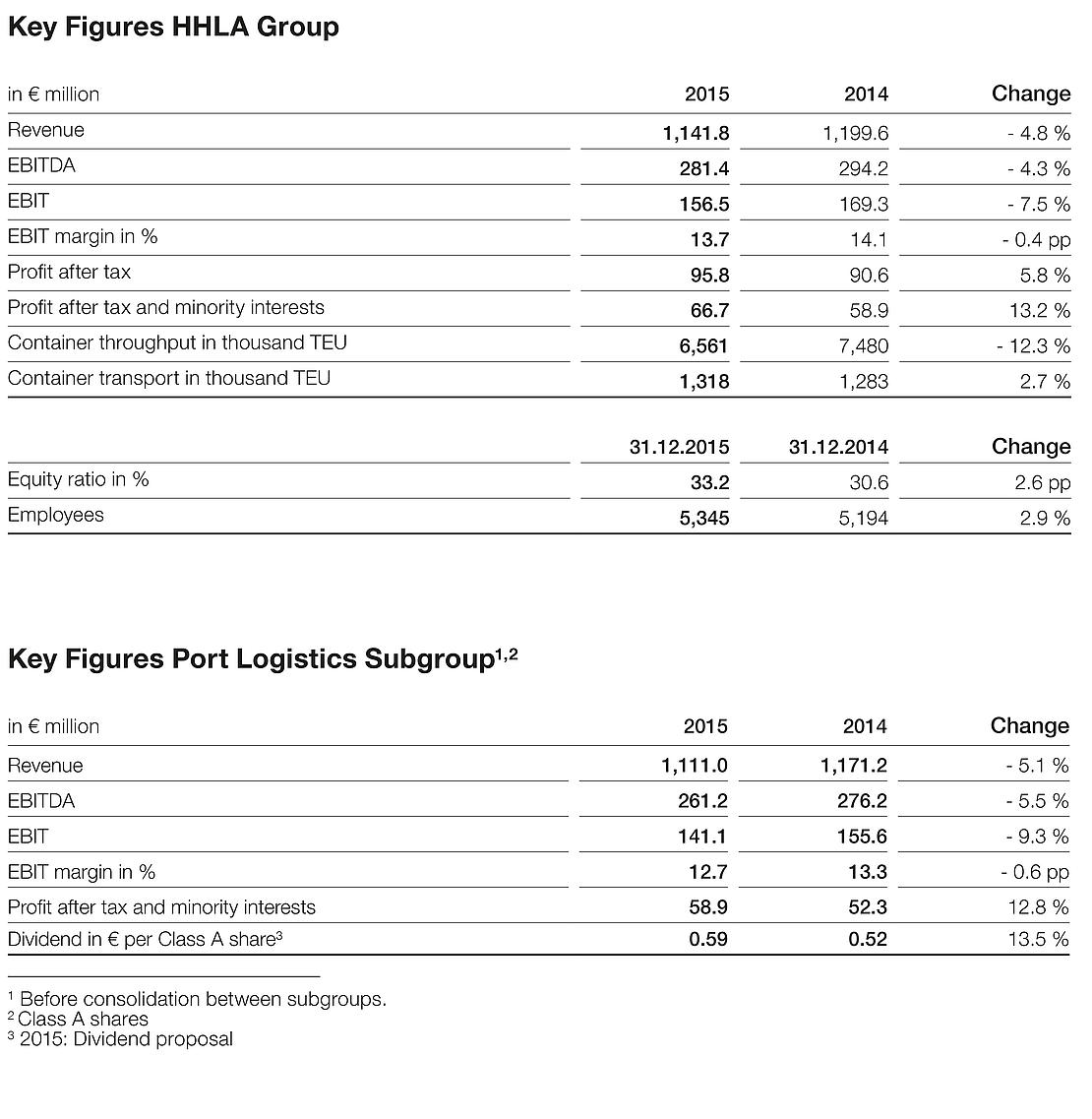

- At 6.6 million TEU, container throughput falls below the previous year’s figure by 12.3 %

- Further increase of 2.7 % in container transport to 1.3 million TEU

- Operating result (EBIT) of € 156.5 million is 7.5 % below the previous year’s figure

- Profit after tax and minority interests up by 13.2 % year-on-year at € 66.7 million

- Dividend proposal: up 13.5 % to € 0.59 per listed Class A share

- Outlook for 2016: Container throughput on a par with the previous year, slight increase in container transport. Operating result after one-off consolidation expenses expected to come in the range of € 115 million to € 145 million

Hamburger Hafen und Logistik AG (HHLA) increased its profit after tax and minority interests by around 13 percent in 2015. While container throughput of HHLA declined in the 2015 financial year due to a persistently challenging environment, HHLA’s Intermodal companies saw a very pleasing development, with an operating result (EBIT) that more than doubled. As a result of its successful diversification strategy, HHLA achieved sound revenue overall in the past financial year and an operating result of almost € 157 million. The Executive Board and the Supervisory Board are proposing a significantly higher payout to the company’s shareholders.

Corporate Development 2015

Despite a persistently difficult environment, HHLA generated revenue of € 1.1 billion and an operating result (EBIT) of € 156.5 million in the 2015 financial year. Revenue fell by 4.8 % compared to the previous year and the operating result was 7.5 % lower. By contrast, profit after tax and minority interests increased significantly by 13.2 % to € 66.7 million.

Seaborne container throughput at the HHLA terminals declined by 12.3 % to 6.6 million standard containers (TEU). HHLA’s Intermodal companies once again increased the volume of transported containers by 2.7 %, to 1.3 million TEU, however, following an already strong previous year. The growth drivers in this case were again HHLA’s rail companies, Metrans and Polzug, which increased container transport by 5.3 %.

Profit after tax and minority interests for the Port Logistics subgroup increased by 12.8 % to € 58.9 million. At the Annual General Meeting on 16 June 2016, HHLA’s Executive Board and Supervisory Board will therefore propose a dividend of € 0.59 per dividend-entitled Class A share – up 13.5 % from the 2014 financial year. For 2015, HHLA intends to payout € 46.0 million in total to the shareholders of the listed Port Logistics subgroup and the non-listed Real Estate subgroup.

HHLA’s Chairman of the Executive Board, Klaus-Dieter Peters: “The results achieved in the 2015 financial year once again confirm our strategy of positioning and further expanding the Intermodal segment as a second strong pillar alongside the Container segment. Our rail activities are by now contributing substantially to the earnings and stability of the Group. The challenging environment – the weak global economic, trade and container throughput growth, China’s slowing economic growth, the severe recession in Russia and the economic crisis in Ukraine, where we managed to reduce the impact of the lower throughput at our Container Terminal Odessa by gaining market share – was felt particularly in seaborne container handling at our Hamburg terminals. On top of this, there were persistent infrastructure deficits that led to a drop in volumes in light of renewed fierce competition and further increased capacity.”

Outlook for 2016

In view of the forecast economic developments and the prolonged regional risks, as well as the existing infrastructure deficits, HHLA anticipates that container throughput will be on a par with the previous year, and that container transport will once again see an increase in volume in the 2016 financial year. Group revenue is expected to remain unchanged against the previous year. The Group’s operating result (EBIT) is expected to come in the range of € 115 million to € 145 million, following one-off consolidation expenses in the Logistics segment.

HHLA’s Chairman of the Executive Board, Klaus-Dieter Peters: “In order to exploit the opportunities available to us in a targeted manner and to reduce one-sided dependencies and risks, we are using our diversification strategy to focus on several major pillars for the future of the Group. First of all, we will maintain and build upon our market leadership in Hamburg. To achieve this, we will continue with preparing our container terminal for handling particularly large ships, and increase our productivity by further automating and optimising our processes. Secondly, we will expand the network of our Intermodal companies by operating new connections and establishing new locations for European port hinterland and continental traffic. In 2015, more than 50 percent of our Group investments went into developing our rail companies, which recorded a high level of added value with their own rolling stock and their own hub and inland terminals. We are currently investing in a further hub terminal in Budapest. Our third aim is to achieve accelerated horizontal growth through expanded regional and product strategies. We are going to intensify our search for attractive port projects in growth markets and to systematically exploit the opportunities available.”

The Annual report is available at:

report.hhla.de/annual-report-2015