It’s a hive of activity at the ferry terminal in Aktau, on the eastern shore of the Caspian Sea. Inside the belly of a ship are railway wagons, while on land Turkish trucks wait to be let on board. Although the vestiges of the Soviet Union still remain at the Port of Aktau, the Caspian Sea is developing into a hub for Eurasian trade. As a result of geopolitical tensions with Russia, the transport market is looking for new routes along the Silk Road from Europe via the Caucasus to the Chinese border. And HHLA is also involved when the courses are being set for a growing business.

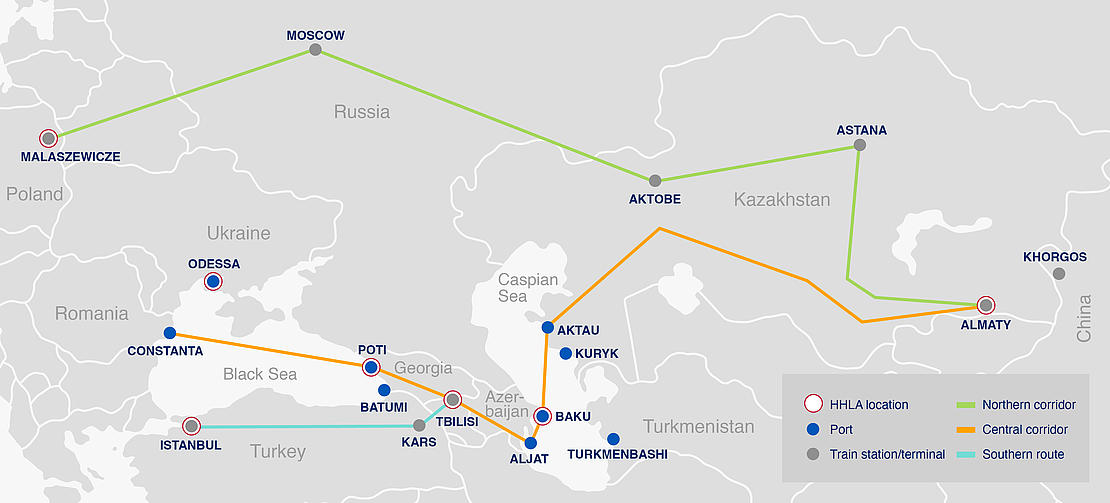

The “Iron Silk Road” has developed as an alternative to the sea route between China and Europe since Chinese President Xi Jinping launched the “Belt and Road Initiative” (BRI) ten years ago. The northern corridor through Russia proved to be the fastest option at acceptable costs. At peak times, up to 1.5 million standard containers (TEU) per year were transported along the Trans-Siberian Railway or further south via Moscow and Kazakhstan. HHLA subsidiary Metrans positioned itself on the northern corridor at the start of January 2022 by acquiring CL Europort, with a logistics centre in the Polish city of Malaszewicze. At the same time, a strategic partnership was entered into with the rail transport company Eurotrans, which serves the northern route.

Focus shifts to the CTCN central corridor

Since the Russian war of aggression in Ukraine, it is less hectic at the Malaszewicze hub. “In the first quarter of 2023, around 80 percent of trains on the northern route from China were bound for destinations in Russia; only 20 percent continued on towards Europe,” explains Martin Koubek, Director Silk Road & CIS Countries at Metrans. Although rail transit transport is not affected by the EU’s 11th package of sanctions against Russia from June 2023. But the central corridor, called the Central Trans-Caspian Network (CTCN), is moving further into focus.

If the transit time between Europe and China via Russia is around 14 days, we need to find a similar solution.

From Europe, a section of the CTCN runs overland through Turkey via Kars. At the end of October 2017, a railway line via Armenia and Georgia to the Azerbaijani port of Baku commenced operations here. Alternatively, there is a connection from the Romanian port of Constanța across the Black Sea to the Georgian port of Poti, and then on to Baku by rail. Koubek considers these alternatives from the customer’s perspective: “If rail freight transport between Europe and China via Russia has a transit time of around 14 days, we need to find a similar solution.”

Highly fluctuating predictions

Frank Busse, partner at HHLA subsidiary HPC Hamburg Port Consulting, has looked after projects in the region for years. He calls the infrastructure on the entire route “limited”. According to him, the transport volume on the central corridor is around 80,000 TEU at present. Various studies forecast an annual transport potential of between 130,000 and 850,000 TEU by 2040.

As a result, capacity in the Kazakhstani ports of Aktau and Kuryk is to be increased to up to 120,000 TEU. Currently, only around 30,000 TEU per year are handled in Aktau. Although Azerbaijan’s western ports on the Caspian Sea in Baku and Aljat are “better positioned”, the rail connection between Baku and Poti “is not equipped to transport hundreds of thousands of additional containers,” explains Busse. The infrastructure on the Caspian Sea towards the west is therefore increasingly being expanded, he says. Port expansions are also planned in Turkmenbashi (Turkmenistan) and Baku, he adds.

Transport volume

Central corridor

HPC advises many partners in the region

HPC is currently active in Almaty, Kazakhstan’s logistics centre: “We are advising the private operator ALG on the future development of its rail terminal,” says Busse. Its capacity is to increase from 15,000 containers per year at present to 50,000 containers by 2035. To achieve this, ALG urgently needs new equipment such as cranes and reach stackers, while parts of the rail infrastructure have to be upgraded (see the latest press release too).

Prior to this, HPC was selected to provide its extensive IT management services in order to set up a national maritime single window (NMSW) in Georgia. The introduction of a platform like this will increase the transparency of official processes in seaborne trade and promote multi-agency cooperation. This will enable Georgia to position itself better as an important hub along the central corridor and a gateway to Europe. However, the digitalised data exchange is not yet functional between all the various parties on the Black Sea.

“Global Gateway” as an alternative to the BRI

Marketing of the CTCN also lags behind the Chinese BRI marketing strategy. Now Brussels wants to catch up using its “Global Gateway”. It is intended as “Europe’s initiative to connect the world through investments and partnerships”. As part of this, the European Bank for Reconstruction and Development (EBRD) examined existing and potential transport corridors in Central Asia up until June on behalf of the European Commission. The study proposes measures and infrastructure investments to achieve a maximum volume of 865,000 TEU on the CTCN with a transit time of 13 days between the EU and Asian hubs.

To enable this, the 290-kilometre stretch of railway between Almaty and Khorgos in Kazakhstan would need to be expanded to two tracks and electrified, for example. In addition, port capacity in Aktau and Kuryk is to be improved. The EBRD study assumes that container transport on the Caspian Sea between Aktau and Baku will increase from 18,000 TEU in 2022 to 130,000 TEU in 2040. In addition to HHLA, other German companies want to play a part, including Rhenus Logistics. The Group has signed a corresponding declaration of intent with the Kazakhstani state railway operator KTZ. In concrete terms, a container hub is planned in the Port of Aktau and more transit cargo is to be switched to the Trans-Caspian route.

Importance of Georgian Black Sea ports grows

Korneli Korchilava, Managing Director of HHLA Project Logistics, based in Poti, is already noticing this: “The volume on routes between the Georgian Black Sea ports and Central Asian countries is growing.” Since the start of 2023, he has recorded an increase of more than 50 percent compared with the previous year. In addition to Tbilisi and Baku, the HHLA subsidiary has also had an office in Almaty since the end of February.

“The volume on routes between the Georgian Black Sea ports and Central Asian countries is growing.”

For large orders between Baku and destinations in Kazakhstan, HHLA Project Logistics can switch project cargo from road transport to the potentially more environmentally friendly rail transport. On one occasion, around 5,000 tonnes of pipes were transferred in Baku before crossing the Caspian Sea from Alyat to Aktau. On another, a container unit train was organised from the Port of Aktau via Khorgos to China. In the Port of Poti, containers are transferred from ships to container unit trains and transported to Baku by the Azerbaijani rail operator ADY. Although this is a good start, trucks are often simply more competitive at present.

“The usually privately owned road transporters are more flexible and mobile,” says Korchilava. That is why, he says, united efforts are now necessary to overcome bottlenecks on the railways. He regards the establishment of a joint logistics company, which the prime ministers of Kazakhstan and Azerbaijan agreed on in June, as a step in the right direction. The agreement should standardise rates and freight handling on the CTCN and shorten transit times to between 10 and 15 days in the future.

Expansion of railways planned

According to a report in the “Astana Times”, current plans include the expansion of the railway line to two tracks between Dostyk on the Chinese border westwards to Moyinty, a container hub in the Port of Aktau and a bypass railway for Almaty train station. “Authorities at local level such as customs, ports and railway companies must be actively included in this process,” stresses Korchilava./p>

In the meantime, HHLA Project Logistics is focusing on creating a regular unit train system: “We are negotiating new agreements with the relevant parties in the countries of the central corridor,” says Korchilava. For several months, his team has been receiving more and more requests from EU countries for project cargo to Kazakhstan and Uzbekistan, he adds. “This development is encouraging us to further expand our network in Kazakhstan,” he says./p>

HHLA International is driving the expansion of the network. According to Managing Director Philip Sweens, the presence in Azerbaijan and Kazakhstan is “very important in order to make knowledge available locally, be present among local decision-makers and ensure good delivery quality.”/p>

While there has long been a representative office at the important hub in Baku due to the oil industry, HHLA Project Logistics has now taken a "big step" with new offices in Astana and Almaty. Business in the world’s biggest landlocked country is growing fast, the region is rapidly changing and supply chains are being “reorganised”. Kazakhstan could potentially be a springboard into Uzbekistan and other “-stan” countries “to see whether we should have a stronger presence there as well in the future”. There would then be even more activity along and across the Caspian Sea.